The following analysis of the real estate market in select neighborhoods in the Wasatch is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions.

ECONOMIC OVERVIEW

Much like the rest of the nation, COVID-19 had a very significant impact on employment levels in Utah; the state shed 140,000 jobs in only two months.

However, I am delighted to report that-as of the end of the first quarter-the region has not only recovered all of the jobs that were lost, but employment levels are now 11,300 jobs higher than the pre-pandemic peak in February 2020.

With the recovery complete, at least for the time being, the unemployment rate continues to drop and is currently only 2.9%. At this level, Utah-along with Nebraska, South Dakota, and Vermont-now has the lowest jobless rates of any states in the Union.

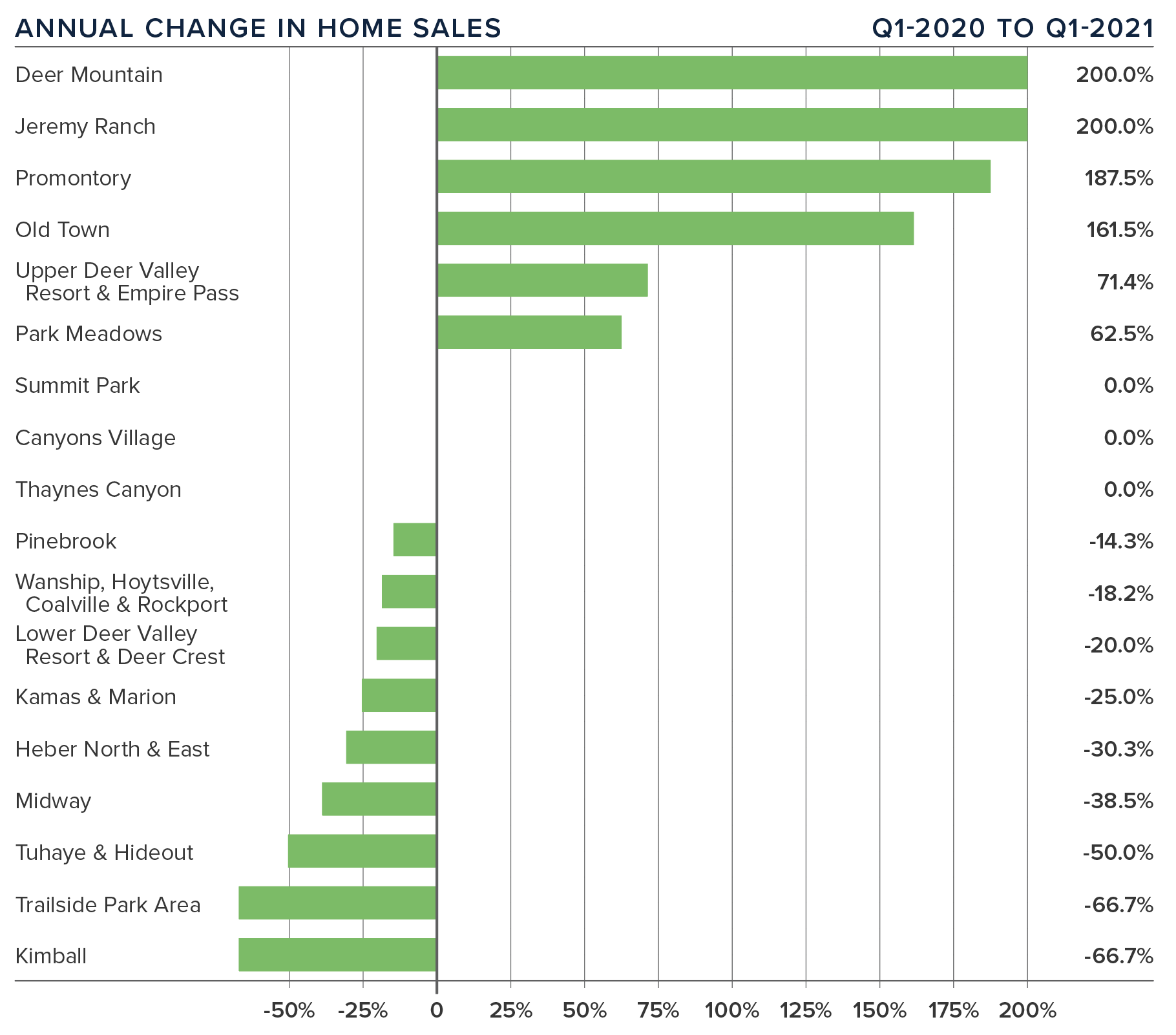

HOME SALES

Only 87 homes sold in Park City in the first quarter of 2021. This was 38.1% higher than in the first quarter of last year, but 82% lower than in the fourth quarter of 2020.

Sales rose in six markets, remained static in three, and dropped in nine.

Inventory levels remain well below the levels I would like to see, with the average number of homes for sale down 49.8% from a year ago and 77.5% compared to the prior quarter.

Pending home sales were 96.3% higher than a year ago but were down 75.7% from the fourth quarter of 2020 as the lack of inventory continues to limit sales activity.

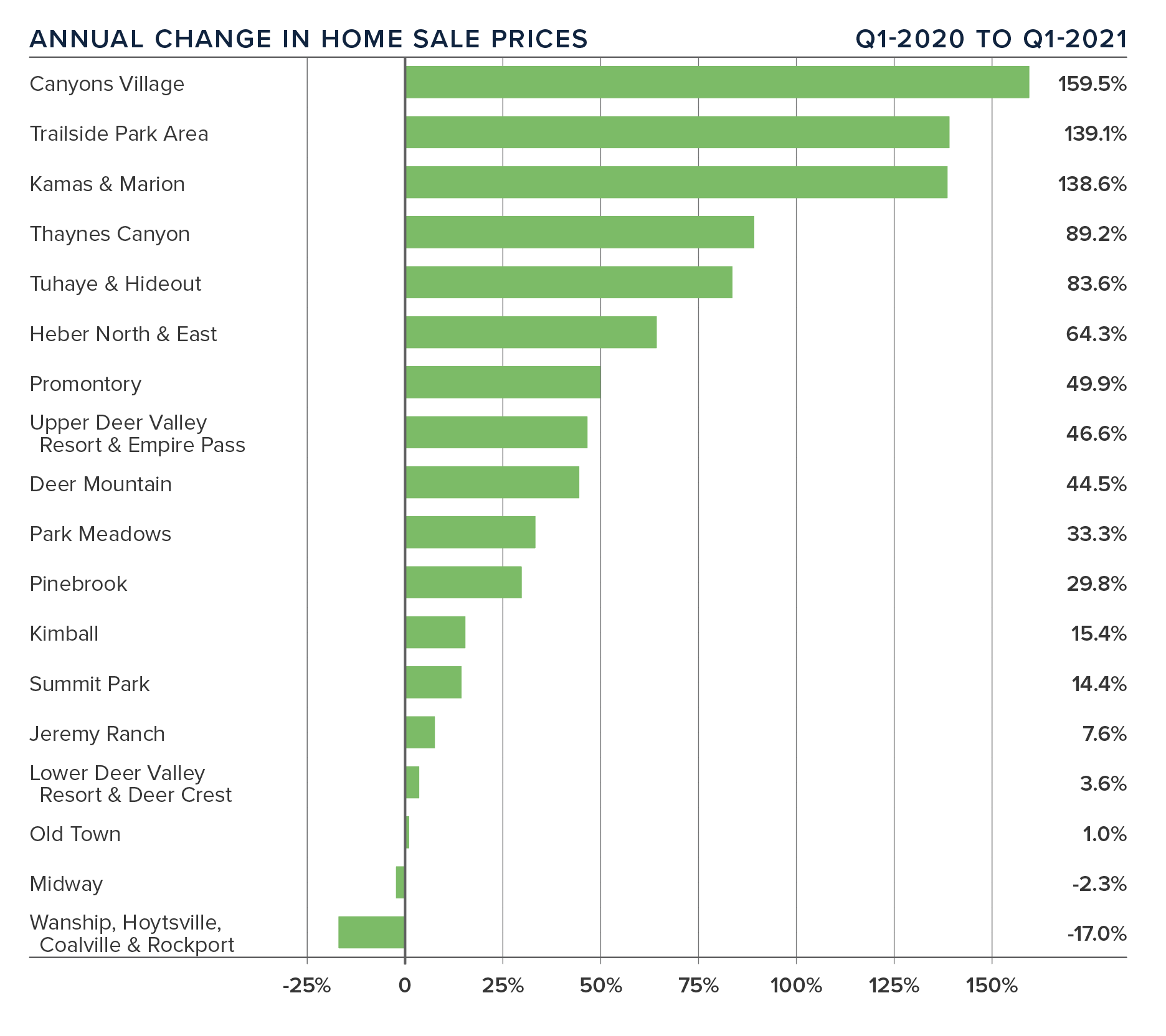

HOME PRICES

The average home price in the Park City neighborhoods contained in this report jumped 70.4% year over year to $2.673 million. Sale

prices were 73.2% higher than in the fourth quarter of 2020.

The most affordable neighborhoods relative to average sale prices were in the Wanship/Hoytsville/Coalville/Rockport and Kimball neighborhoods. The most expensive home sales occurred in Canyons Village, where the average sale price hit $13 million.

Prices rose in all but two neighborhoods,

with double-digit increases in 13 markets.

Of note is that all but four neighborhoods saw

sale prices in the quarter exceed $1 million.

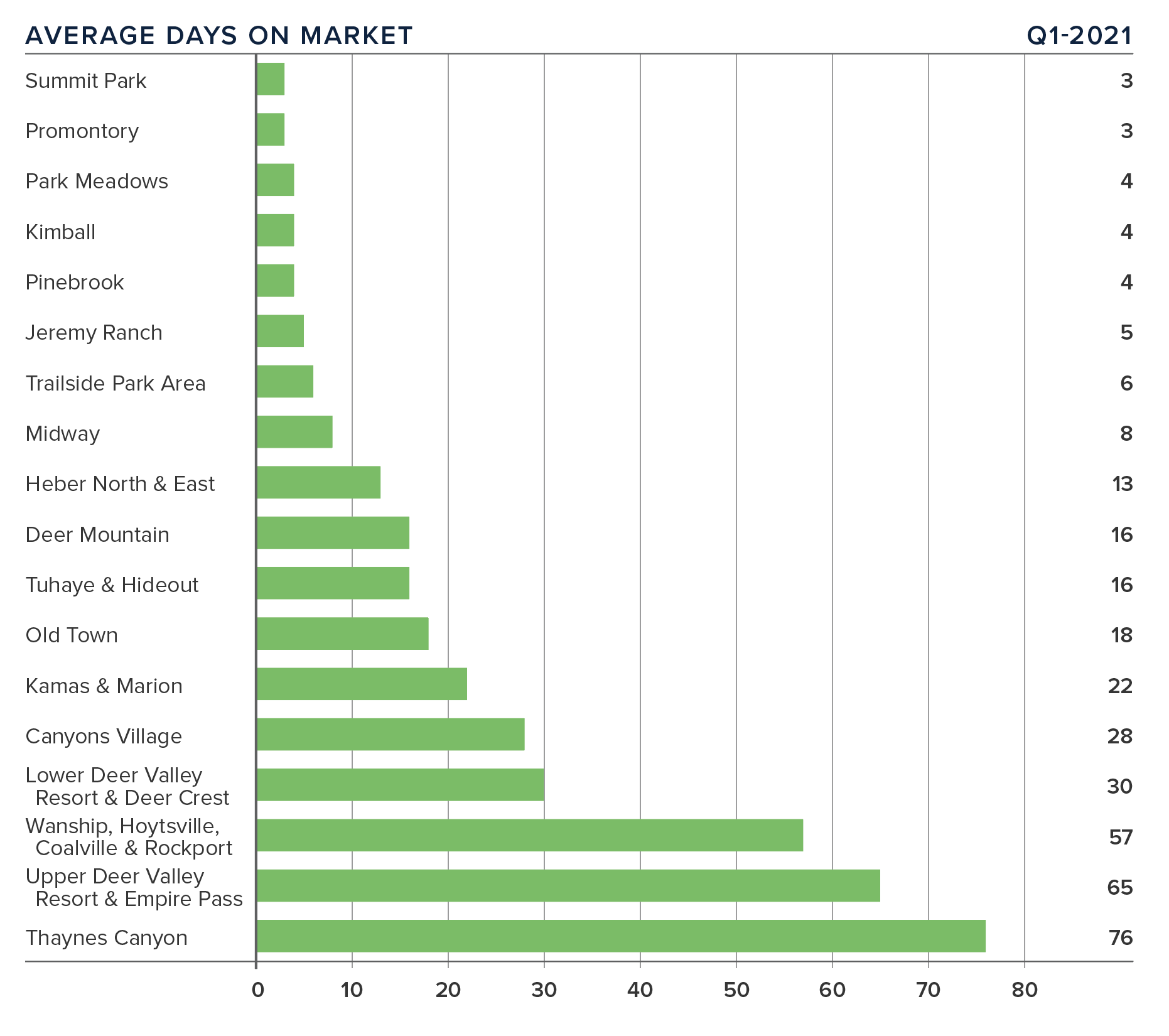

DAYS ON MARKET

The average time it took to sell a home in the Park City area dropped 100 days compared to the first quarter of 2020.

The amount of time it took to sell a home dropped in all but four neighborhoods compared to the first quarter of last year.

In the first quarter, it took an average of only 21 days to sell a home, with homes selling fastest in the Summit Park and Promontory areas, and slowest in the Thaynes Canyon neighborhood.

The significant decline in market time can again be attributed in part to the local listing service instituting a rule that led new construction developments to add sales "en-masse." This lowered market time dramatically.

CONCLUSIONS

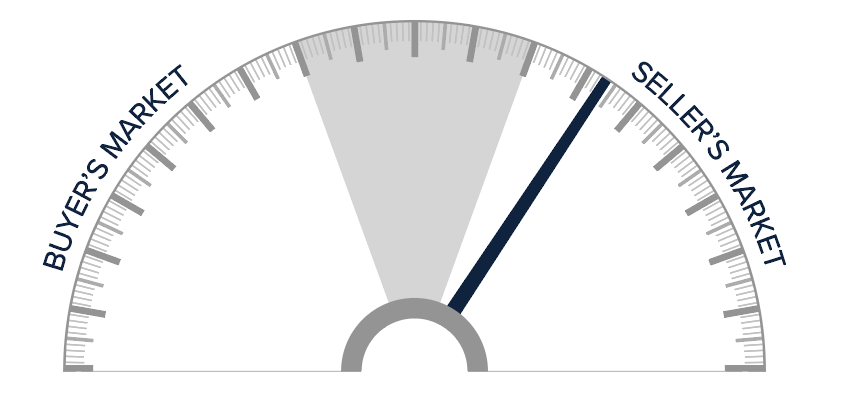

This speedometer reflects the state of the region's real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Although mortgage rates have risen recently, they remain very competitive compared to historic averages, and buyers are taking advantage of this. I would like to see far more homes for sale, but do not anticipate that this will occur in the near term.

The lack of housing inventory is not only frustrating buyers, but owners who are thinking about selling are unlikely to come to market unless they have found a home to buy. If there is nothing to buy,

there is no compelling reason to sell! Given all these factors, sellers still have the upper hand. I am therefore moving the needle a little more in their favor.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.